We Need a Housing Crash Because We Are Past Due for a New Economy

Long-term suffering is only compounded when we defer inevitable pain for short-term gain

I grew up believing that new appliances must be insanely expensive, because my parents were fixated on repairing (rather than replacing) things well past their prime. It wasn’t about frugality (though I’m sure they’d argue otherwise); it was more about procrastination and short-term thinking. They acted like replacing something would always be the bigger hassle - preferring to work with what they had, even if it barely worked.

Once I was grown, I was genuinely puzzled to discover that many of these appliances were actually quite cheap (relatively speaking). So why then, I wondered, did they willfully choose the constant and unpredictable disruption of repairs? It all seems so silly in retrospect, considering the cost of all those repairs could have paid for new models many times over - and that this would have been a far more reliable (and far less frustrating) way to deal with things.

There was so much unnecessary drama, like when the nice clothes I bought as a teenager with money from my little candle shop job were ruined - more than once - by our faulty washing machine. The sustained squabbles that inevitably followed, especially when I suggested paying to replace whatever machine was once again on the fritz, still baffle me. I was always told I didn’t understand the true cost - but as it turns out, it was actually me who did.

Despite myself, I too - being human - still sometimes put off fixing things (though nowhere near as much as my parents did), building up in my mind how stressful it will be to deal with them. But every time I finally just do what needs doing, I wonder why I waited so long. The effort is always worth it, ultimately making my life easier - even if it’s a bit of an ordeal in the moment. At least I no longer have the stress of worrying about it, knowing there’s one less thing hanging over my head that I can’t avoid forever.

We all like to avoid stress. Even more, we like to avoid pain. But refusing to face things often ends up causing more of both than it defers.

About a year and a half ago, I argued that we’ve let our housing crisis get so bad that a crash is now our least bad option to solve it. At the time, fewer people were willing to think this was even possible, let alone say it. But now, as it looks increasingly likely, what too many people are still saying is that anyone hoping for it clearly doesn’t understand that it will affect way more of the economy than just housing.

But I’ve actually become increasingly convinced of my own thesis precisely because a housing crash would upend our wider economy - and I believe it needs that level of reset to work again.

A big part of the reason I feel this way is that otherwise, we're asking people who never had the same opportunities to succeed to endure long-term pain so those who had the luxury to make bad choices can avoid their consequences.

It’s like teen me, watching the nice clothes I worked hard to buy get ripped up yet again in the spin cycle of doom my parents refused to deal with - writ large, and writ much more important.

I’ve also written before about how the housing crisis has left many without a fair chance to get ahead, but what bothers me more and more is the resignation creeping into conversations about it. More people than ever voice their worries about the crisis, along with the broader issue of the rising cost of living. But too often, there’s a hint of “well, what can you do?” in their tone - when in reality, we can do a lot.

The problem is that the most meaningful solution - prices coming down significantly - remains unspeakable to those more worried about people who promised themselves they could retire on their house value than about those who will never have a chance at a stable home or retirement.

I don’t think anyone will do anything meaningful about it, though - a feeling reinforced by recent, increasingly desperate moves across all levels of government in Canada, along with similarly desperate interventions propping up barely less fragile housing markets across the wider Western world.

Which is exactly why I feel we need something to force change. The machine needs to break, or we’ll keep getting subjected to the same cycle over and over again.

Because it’s quite obvious our governments will do absolutely anything to prop up our overly housing-focused economy for as long as they possibly can, beyond all reason - keeping us all spinning our wheels in futility.

One (almost too) commonly cited wrench in the works of Canada’s sputtering economic engine is immigration, and of the temporary variety in particular.

Our Temporary Foreign Worker Program, (all too) famously dubbed a "breeding ground for contemporary forms of slavery” is just one part of a much broader, deliberate effort to inflate the economy through human capital.

Even more problematic, more heavily used - yet somehow far less discussed - is the International Mobility Program, which has brought over a million temporary workers into Canada without even requiring a Labour Market Impact Assessment (which itself has proven exploitative at its core).

These labour market pressures, along with the massive increase in international students, haven’t just boosted profits for businesses (and universities) - they’ve also kept housing costs elevated. More precarious temporary residents are crammed into overpriced rentals, while wealthier ones help sustain high home prices by entering the market as buyers.

Basically, when the government’s use of quantitative easing through monetary policy to defer the consequences of Covid lockdowns led to the expected inflationary outcomes, they shifted to the human equivalent of quantitative easing.

I suspect this was all done to ensure their preferred method of controlling inflation - wage suppression - would prevail over any possibility of prices coming down, particularly in housing (which, it should be noted, was their top priority, over even PPE, when the pandemic hit).

And now, while our federal government is set to clamp down on its own immigration policies, there’s evidence that these actions may be more about saving face than learning from mistakes.

With fewer international students arriving of their own accord and fewer temporary residents opting to apply for permanent status - likely because they’re seeing just how hard it is to thrive here - the government seems to have figured they may as well take the political gain if the economic fallout is inevitable anyway.

This all seems to prove that real progress might only happen through forces beyond their control - like a crash. Governments won’t choose to fix housing - but it might just fix itself in spite of them.

We’re already seeing reductions in students and workers affecting rents, university budgets, and businesses that had grown used to ever-surging demand - and the commensurate rise in their whining about its absence. This seems to contradict what I remember being told - that poorly planned immigration was just a scapegoat, not a cause of our eroding quality of life.

It’s similar to how we’ve been told the issue with housing is simply that we need to build more - more than we ever could - and that our poor, altruistic developers just can’t build for affordable prices without more favourable policies.

Even though falling rents following slowed immigration show that supply and demand play a role, the bigger issue remains the financialization of housing - a reality this framing tends to downplay.

I think discussions around things like development charges or land transfer taxes do have some merit, but they’re closer to being scapegoats, themselves. While these costs contribute to rising prices, they aren't the real problem.

Ultimately, developers aren’t holding off on new housing supply because of an extra $25K here or there - they’re waiting until they can sell what they build at the same inflated prices, overall.

Blaming development charges is like offering a GST holiday - it’s a token gesture that doesn’t address the underlying problem. It reflects a broader belief that inflation is inevitable and deflation is somehow worse, so we end up with temporary “breaks” instead of the lasting solutions we actually need.

This feels reminiscent of trickle-down economics - and the odd reverence for drug companies during Covid (now contrasted with the celebrated murder of the insurance company guy). Just like I’m still the kind of vintage liberal who doesn’t entirely trust big drug companies to be well-intentioned, I don’t buy the idea that cutting development charges will ultimately lead to savings being passed down - especially if the market were to rebound.

“Fixes” like these essentially keep prices exactly where they are - just without the taxes. Every part of the development process has adjusted to inflated costs, with too many thirsty people blaming each other for draining the well.

It’s not, in any gestalt sense, about whether we can build more affordably. Homes aren’t fundamentally unaffordable because of add-ons like development charges, taxes, or fees - they’re unaffordable at their core because base prices were allowed to become so ridiculously inflated that everything in the system - including, but far from limited to, these secondary factors - has been built around the "certainty" of maintaining or pushing them even higher.

This mentality explains why we’ve compromised our once enviable immigration system - not to foster innovation or address real needs, but to prop up unsustainable businesses that rely on suppressed wages. Governments prioritize controlling inflation in ways that protect housing and asset values, instead of fostering an economy where innovation and productivity can thrive.

It’s also why an older cousin of mine and her husband - who, with very average jobs and salaries, were able to buy a home in the suburbs affordably before prices shot up - felt encouraged to use their gifted equity (via HELOC) to fund things like installing a pool, tearing it out, and then putting in yet another one. They’d still have a comfortable life if home prices hadn’t skyrocketed - but they wouldn’t be so awash in luxury.

Meanwhile, a younger cousin, working harder in a more forward-thinking, competitive field, is now considering moving back to their parents’ house at 30 - with their partner, who’s in a similar position.

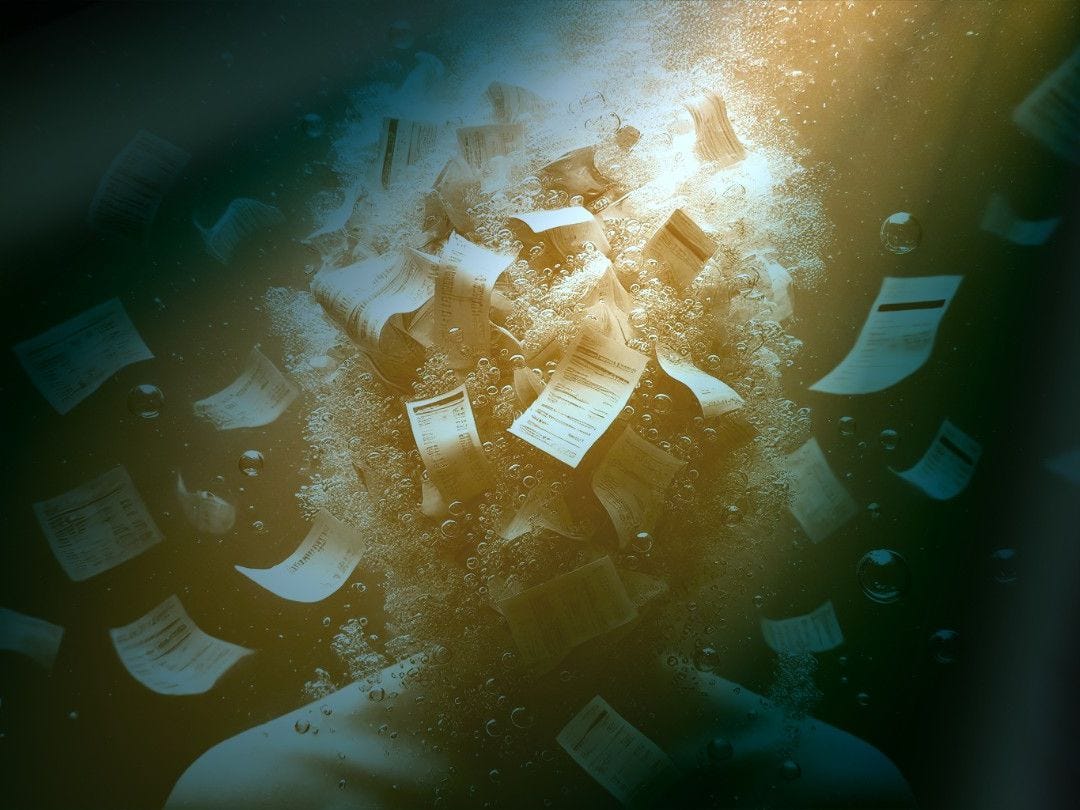

We’re trapped in an economy where it’s sink or swim - but the pull of the status quo drags new energy and ideas under.

When assets and schemes make more money than actual work, why bother putting in the effort? Our real estate-driven economy rewards grift over productivity, stifling innovation and leaving younger generations with little hope if they lack the means to buy in and play a role in keeping the whole thing afloat.

Your utility as a younger person is to sustain this cycle - not to disrupt it.

And yet, millennials - the next largest generation - have managed to push for some changes, much to the dismay of older generations. The post-Covid paradigm shift to remote work persists, despite the best efforts of those desperate to protect the value of commercial property and the condos they bought around it.

We need to lean into this momentum. Let the parts of the system that no longer work - or that we no longer want to work - fail entirely. Stop buying in.

This is exactly what they don’t want. It’s why they insist on calling what we’re experiencing a "vibecession" rather than the actual recession it is. They want you to feel it makes sense to spend your money now - not wait for better options and opportunities - because waiting is what crashes economies.

The idea of millennials “killing” things used to be a running joke - from napkins and processed cheese to diamonds. But the truth is, we haven’t killed nearly enough. We’ve been held back by a system skewed to preserve the status quo for older generations with assets, leaving younger generations without a real chance to change it.

I’ll note that the only things we’ve truly managed to decisively kill are the ones we could simply stop buying - unlike work, which isn’t something you can easily opt out of entirely. Some we didn’t want, and many more we simply couldn’t afford.

If we refuse to act as the perpetual fix for this faltering system, it will inevitably start to spin out. Once the powerful have less paper wealth to throw at keeping it going, we’ll inherently gain more power to override it.

That’s why the whining from developers, investors, businesses, and policymakers is getting louder. All the desperate moves we’re seeing suggest we’re closer to a crash than many realize. We likely only need to hold out a little while longer to let this happen - and finally see some real change.

Don’t let them convince you this is your last, best chance to buy anything. The rhetoric of “just make the monthly payments” ignores how quickly things like interest rates can change - and how devastating that can be if you’ve paid too high a price (a lesson we should all have learned by now). If enough of us wait, better opportunities will come sooner than you think. Don’t respond to anything but real price drops.

When faced with anything you really must buy or rent, ignore any inflationary rhetoric. Lowball. A price is only set when someone agrees to pay it.

This shift has already started on its own - because, once again, we simply can’t afford things as they are. But it’s also because we’re realizing they just aren’t worth it. The deal we’re being offered isn’t the same. Housing isn’t a source of stability for us - it’s a constant strain, even for the "lucky ones”, leaving little room for anything else we might need or want in life.

That’s why things are falling apart so easily with historically still rather low interest rates. Nobody can afford the extras anymore - which is exactly why we’re seeing measures like a GST holiday targeting those very extras.

If you’re on the edge of any housing-related decision, always take the option - at least for now - that involves not buying in or refusing to pay more. We’re on the brink - just a little more pressure will tip it over.

We’ve designed an economy dependent on maintaining extreme, unsustainable conditions in perpetuity - ensuring established generations never have to take a little less, even if it means the rest of us never have enough.

The housing system isn’t sustainable, and neither is the economy that depends on it. Let it break - and let’s finally replace it with something that doesn’t tear us apart, as my clothes once were, by decisions not our own.

There have been far more prominent voices in real estate circles than mine, such as @ManyBeenRinsed - affectionately known as Woes - who has been warning people for years about the threat of getting “rinsed” by bad investments and market volatility. His sharp, darkly humorous insights have earned him a loyal following for good reason - he’s mostly been right.

But while Woes focuses on cautioning people about the risks of buying into cycles that have run their course, I want to emphasize - because it really should be acknowledged more - the opportunity a crash could present if enough of us choose not to.

Just like my parents should have replaced that old washing machine instead of pouring money into endless repairs, we need to face the reality of our outdated economy. It might be more than a bit of an ordeal in the moment, but in the end, it’s likely the rinse we need to finally come out clean.

I’m tired of living in a cycle where people who “sound the alarm” about the danger of cute little corner shops get way too much traction. We need a de facto wealth redistribution to make progress. Capitalism is supposed to involve resets like this - to keep things improving and evolving.

Crashes are like waves - destructive at first, but they clear the way for calm waters and new shores. Let’s ride this one out and finally build a future for those of us who will still be around to see it.